Here is how to create a new company file. Open MYOB. This will open the MYOB Welcome window.

Click the CREATE tab, and the MYOB File Assistant window/wizard will open

The Introduction screen will first and will tell you that to create a company file, just tell MYOB about your company, answer a few questions about accounting year, choose accounting list.

You can click NEXT to continue or click on the grayed out options on the left (at any time you want to edit, just click the relevant tab):

Company Information

Accounting Information

Accounts List

Company File

Conclusion

Company Information: you must enter the MYOB serial number, Business Registration Number (required) and the rest like Company Name, GST Number, Phone Number, Fax Number, Email Address are optional.

Account Information:

Current Financial Year,

Last Month of Financial Year,

Conversion Month (beginning month of a Financial Year),

Number of Accounting Periods: 12 or 13. If you choose 13 Accounting Periods, MYOB will add an extra column for you to do adjustments, but the number of months remain 12 months.

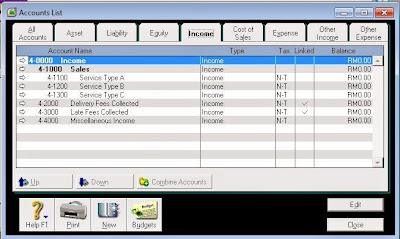

Accounting List: You can Start with MYOB provided list, Import, Build Own List. Whichever selected, it is possible to add or delete later. Selecting MYOB List and Clicking NEXT will allow you to choose your Industrial Classification (Agriculture, Manufacturing, Retail, Service, Others, All).

Clicking any of the first 6 will reveal all the items preloaded by MYOB for that particular industry. If you select ALL, there will be a further drop down menu to select a long list of business ranging from Advertising Business to Wholesale Business.

To view the wholes list of businesses you can select for ALL to to

MYOB Accounting List Choices.

From Help

Company file setup

…The last month of your financial year. This is the month in which your financial year ends. For most businesses the last month is June. * Your conversion month. This is the earliest month for which you…

Related Products: Chart Of Accounts List | Chart Of Accounts Set Up | Change Conversion Month

Setting up MYOB accounting software mid-year

…balances will be reported at the date of your conversion month. Task 4 [Optional] - Assign opening balances to historical months If you need to obtain monthly Profit & Loss and Balance Sheet reports, rather…

Related Products: Setting Up Company File | Payroll Opening Balances | Historical Balancing

Networking 101: Where to go, tools to use and why you should care | MYOB Blog

There's an old adage: It's not what you know €”it's who you know. But when we are starting out in business, our networks are often limited, consisting of former colleagues, friends and family. And while these people will help get you on your way, very few of us can rely entirely on them for business success. That's where networking comes in.

Related Products: Mobile App

Glossary of accounting terms

…accrued depreciation account. Contra accounts can also be used as suspense accounts. Conversion Month - The month in which you start entering transactions in MYOB. Cost: Item - The cost of an inventory…

Related Products: Retained Earnings | Current Year Earnings | Cost Of Sales

3 ways to simplify your payroll process this month | MYOB Blog

The big race to provide your employees their PAYG Payment Summaries is about to begin. Here are three ways you can simply your payroll process this month to ensure you provide the PAYG Payment Summaries to your employees by the 14 July deadline and the PAYG Payment Summary Statement to the tax office by 14 August.

Related Products: Reconcile Payroll | Month End Reports | Payg Payment Summary

Entering pre-conversion deposits

…10:02 AM How do I enter pre-conversion deposits? It is common for businesses to receive a partial payment as a deposit against an order placed by a customer. Conversely, orders placed with a supplier…

Related Products: Conversion Date | Supplier Deposits | Sales Deposit

Setting up MYOB accounting software mid-year

…balances will be reported at the date of your conversion month. Task 4 [Optional] - Assign opening balances to historical months If you need to obtain monthly Profit & Loss and Balance Sheet reports, rather…

Related Products: Change Conversion Month | Set Up Payroll Mid Year | Allowances Set Up

Consignment stock - as consignee

…a computer software store. You hold a number of lines on a consignment basis. At the end of each month you notify the consignor of consignment sales. The consignor then invoices you for the stock sold…

Related Products: Consignment Stock Gst | Consignment | Sales Commissions

Setting up MYOB accounting software mid-year

…balances will be reported at the date of your conversion month. Task 4 [Optional] - Assign opening balances to historical months If you need to obtain monthly Profit & Loss and Balance Sheet reports, rather…

Related Products: Set Up Payroll Mid Year | Trade Creditors List | Accounting Basics

Hello? Is this my insurance company? Is anyone there? | MYOB Blog

…- One Resolution. Without breaking your spirit, dear reader, by going into the details of my two-month long baptism of fire in Crisis Negotiation, let me tell you that if I was the writer of that tagline…

Related Products: Commission | Not Responding | Insurance Claim

Receivables reconciliation out of balance

…Account Opening Balances you will see the following window. The amounts shown here relate to the conversion month or time at which you began using this particular company file to track your balances and transactions…

Related Products: Out Of Balance Receivables | Trade Debtors | Receivables Reconciliation

Setting up MYOB accounting software mid-year

…balances will be reported at the date of your conversion month. Task 4 [Optional] - Assign opening balances to historical months If you need to obtain monthly Profit & Loss and Balance Sheet reports, rather…

Related Products: Balance Sheet | Entering Opening Balances | Opening Balances